WTAI Truth in Research Bomb

Welcome to Wizard Trading AI, LLC!

Will history repeat itself? Let's see...

Since 1957, the average bull market has lasted nearly five years and generated an average S&P 500 return of more than 169%. Bull markets have historically performed best during the first year following the previous bear market bottom, averaging a 41.8% gain.

October 1970- April 1, 1971

Many analysts have compared our current market to the 1970's. Let's pretend we are in late 1969. According to Grok," in late 1969 to early 1970, The S&P 500 and Dow Jones Industrial Average (DJIA) experienced a decline. The S&P 500 dropped from 97.97 to 86.84, and the DJIA fell from 814.39 to 763.83. The environment was as follows:

- Recession: The U.S. economy was in a recession during this time, which negatively impacted the stock market. The recession lasted from December 1969 to November 1970.

- Vietnam War: The ongoing Vietnam War affected the stock market, as the U.S. government's spending on the war led to increased inflation and budget deficits.

- Oil Crisis: In 1970, the U.S. experienced an oil crisis due to a decrease in oil production in the Middle East. This led to higher oil prices and further contributed to the economic downturn.

- Nixon's Economic Policies: President Richard Nixon implemented several economic policies to combat the recession, such as wage and price controls and a temporary suspension of the convertibility of the U.S. dollar into gold. These policies had mixed results and were controversial at the time.

After the drop in early to mid 1970, a "Bull Run" ensued. In the period from October 1, 1970 to March 30, 1971, the stock market experienced some significant events and trends. During this time, the Dow Jones Industrial Average (DJIA) saw a substantial increase.

The DJIA, a widely-used indicator of stock market performance, rose from 734.0 points on October 1, 1970, to 905.1 points on March 30, 1971. This represents a growth of about 23.3% in just six months.

One of the key drivers of this growth was the expansionary monetary policy implemented by the Federal Reserve. The Fed lowered interest rates and increased the money supply, which encouraged borrowing and investment.

Additionally, the economy was recovering from a mild recession in 1970, which contributed to the stock market's growth. The Gross Domestic Product (GDP) increased by 0.8% in the fourth quarter of 1970 and continued to grow in 1971.

The stock market's performance during this period was also influenced by political events. In 1971, President Richard Nixon imposed wage and price controls to combat inflation, which had a mixed impact on the stock market.

Overall, the stock market saw strong growth in the period from October 1, 1970 to March 30, 1971, driven by a combination of monetary policy, economic recovery, and political events.

From March 30, 1971 to May 1, 1971, the growing economic issues of the time, such as inflation and the weakening of the U.S. dollar against other currencies. The decision to end the gold standard, in particular, had a profound impact on the global economy and the stock market.

During this period, the Dow Jones Industrial Average (DJIA) experienced a decline. On March 30, 1971, the DJIA closed at 883.77 points. By May 1, 1971, it had dropped to 864.61 points, representing a decrease of about 2.17%.

On March 1, 1971, the DJIA closed at 890.62 points, and by April 1, 1971, it had dropped to 875.62 points, representing a decrease of about 1.7%.

Another factor that contributed to the decline in the stock market was the increase in inflation. In March 1971, the Consumer Price Index (CPI) rose by 0.3%, which was higher than expected. This increase in inflation led to concerns about the future of the economy and the potential for higher interest rates, which in turn led to a decrease in stock prices.

According to Grok, "The stock market performance from January 30, 1971, to February 12, 1971, saw a significant increase in the Dow Jones Industrial Average (DJIA). During this period, the DJIA rose from 848.30 to 941.10, representing a growth of 11.1%. This period marked a strong bull run for the market, as investors were optimistic about the economic recovery following the 1970 recession.

During this time, several key events and factors contributed to the market's performance. One of the main drivers was the continued expansionary monetary policy by the Federal Reserve, which aimed to stimulate economic growth and reduce unemployment. Additionally, the signing of the Rail Passenger Service Act by President Richard Nixon on October 30, 1970, which led to the creation of Amtrak, was seen as a positive development for the transportation industry.

The market's performance during this period was also supported by strong corporate earnings and a general sense of optimism among investors. However, it is important to note that past performance is not indicative of future results, and the stock market is subject to various risks and uncertainties."

Wizard Trading AI Team-

Several key differences and similarities emerge. First, we aren't technically recovering from a recession. GDP grew by 3.3% in the fourth quarter. Second, the dollar really hasn't weakened. Don't you believe that a weakening dollar will help stocks in the current environment? We do. Similarities are that we do have major political events on the horizon and we are currently in a "conflict" in the Middle East. Inflation is a major concern.

Also, according to Grok and verified by the team, "the stock market performance from October 2023 to January 30, 2024, has been quite positive, with the S&P 500 showing an overall upward trend during this period. The market has been supported by factors such as strong corporate earnings, a stable economic environment, and a relatively low-interest rate environment.

However, there have been some fluctuations along the way. In late October 2023, the market experienced a brief dip due to concerns over rising inflation and the potential for interest rate hikes. However, these concerns were short-lived, as the Federal Reserve maintained its accommodative monetary policy stance and inflation remained within the target range.

The market also experienced some volatility in early January 2024, as investors reacted to news of a new COVID-19 variant that was spreading rapidly in some parts of the world. However, the market quickly recovered as it became clear that the variant was not as deadly as previous strains and that existing vaccines were still effective in preventing severe illness."

Overall, the stock market has performed well during the period from October to the end of January, with the S&P 500 showing a gain of around 8% from October 2023 to January 30, 2024. This performance has been driven by strong earnings growth, particularly in the technology and healthcare sectors, as well as a supportive economic environment."

The stock market in the United States experienced a significant change during the period from February 1, 1971, to March 25, 1971. During this time, the Dow Jones Industrial Average (DJIA) saw a substantial increase, rising from 811.91 points to 874.19 points. This represented a growth of approximately 7.7% in just under two months.

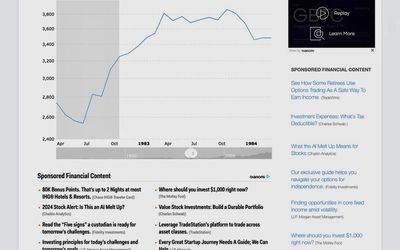

1982 October Bull Market-ended April 1, 1983- Now let's pretend we are in the 1982 Bull market. Accoring to Grok and verified by the Team, "Between October 1982 and April 1, 1983, the stock market experienced a significant price change. During this period, the S&P 500 index rose from 102.42 to 144.60, representing an increase of approximately 41%. This period was marked by a recovery from the bear market of 1982, which was driven by factors such as declining interest rates, lower inflation, and improving economic conditions. Please see chart above.

MAI Team- This situation feels more like today. We had a bear market, recovered, now it seems that economic conditions are getting better with lower inflation and rates lower. Remember the April 1, 1983 date.

1990 bull run= lasted from October 1, 1990 until May 1, 1991- more info soon

2009- Bull run lasted from Feb.1 until May 1, 2009

We are finalizing our research, but if history repeats itself in the stock market, watch out for a drop around April 1 or May 1, 2024. More to come on the severity of the drop in history

Wizard Trading AI Team- If we are in 1971, we see nothing catastrophic on the horizon. Maybe a mild drop. If we are in 1971, for the next 12 days, we will see an 11% growth in the S&P. Are we there? We don't know. Let's see. Truth in research. More to come. We have looked at other Bull periods and feel we are safe until April 1, 2024,- read the entire article for free with no subscription required, please follow.past performance does not guarantee future results and all of that crap... Be sure to follow us @wizardtradingai

1982 Bull Market- ended April 1, 1983

Wizard Trading AI, LLC

Copyright © 2024 Wizard Trading AI, LLC - All Rights Reserved.

Powered by GoDaddy

2-13-24-MAI & Human Good Results/CPI Day

We post Wizard Trading AI, LLC's AI stock and options trade ideas on "X" for free@wizardtradingai. Our team has worked tirelessly for over two years to perfect and backtest this Artificial Intelligence based trading system. This system incorporates the philosophies of legendary super-performer stock and option's traders and classifies that data, along with current market conditions and history, to attempt to beat the market through historical perspective. We don't want your money, just your ears.

This website uses cookies/disclaimer

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data. We are not financial advisors, this is not financial advice, we do not want your money, and you are responsible for using this system along with your own system). We think the financial industry is corrupt(we have been lucky with our advisors in the past but have seen the bad side of the industry) . These trade ideas are simply opinions that you can use in your tading journey and by clicking on this link, I hereby waive any and all legal claims against Wizard Trading AI, LLC, its members, employees, heirs, and assigns.